About.

G’day.

I am Caroline and I’m from Australia. In July 2021, I took that leap and kickstarted my budgeting journey – predominantly savings (and my journey to save for a house). My documented video uploads on Youtube are positive and family-friendly. I would love to inspire others to budget themselves.

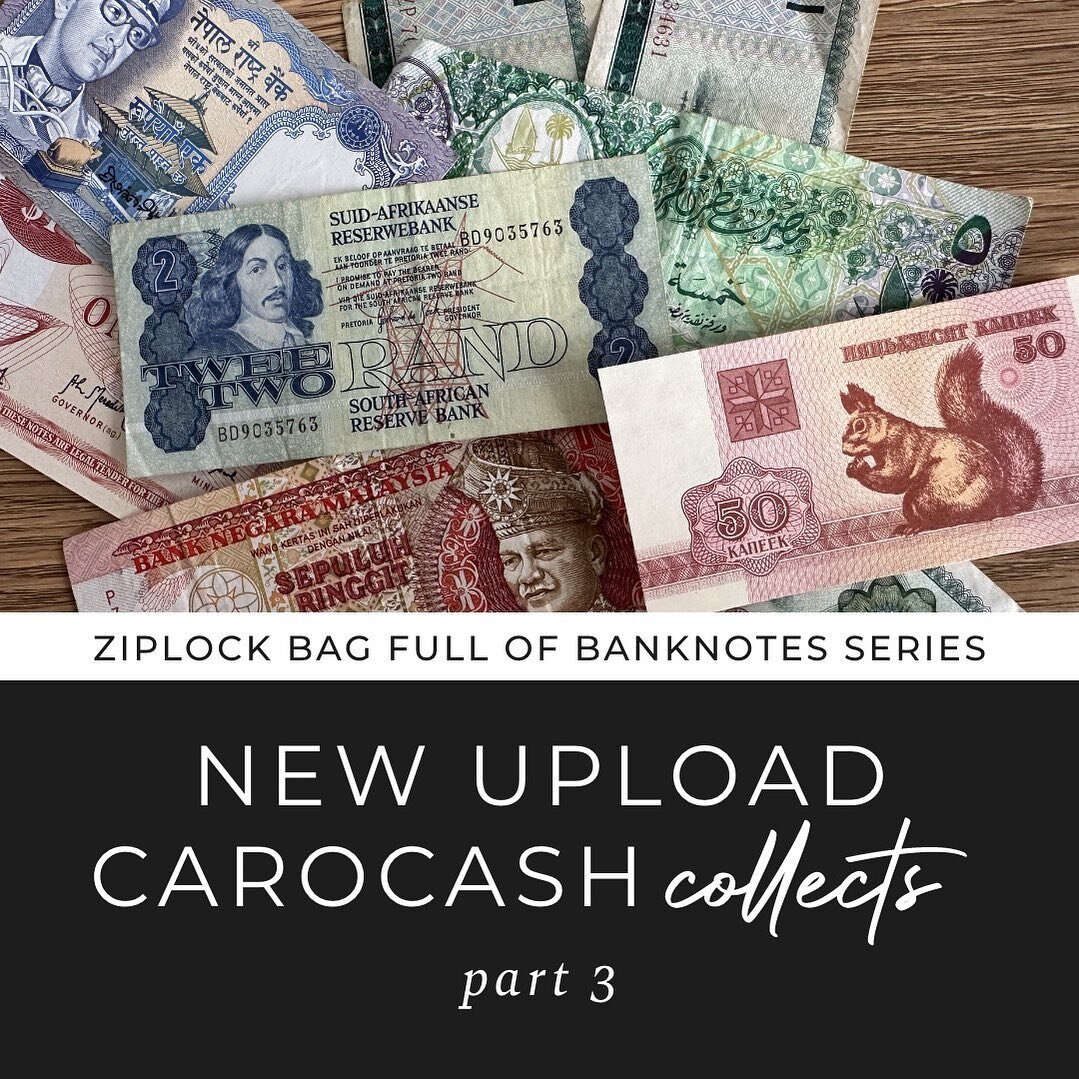

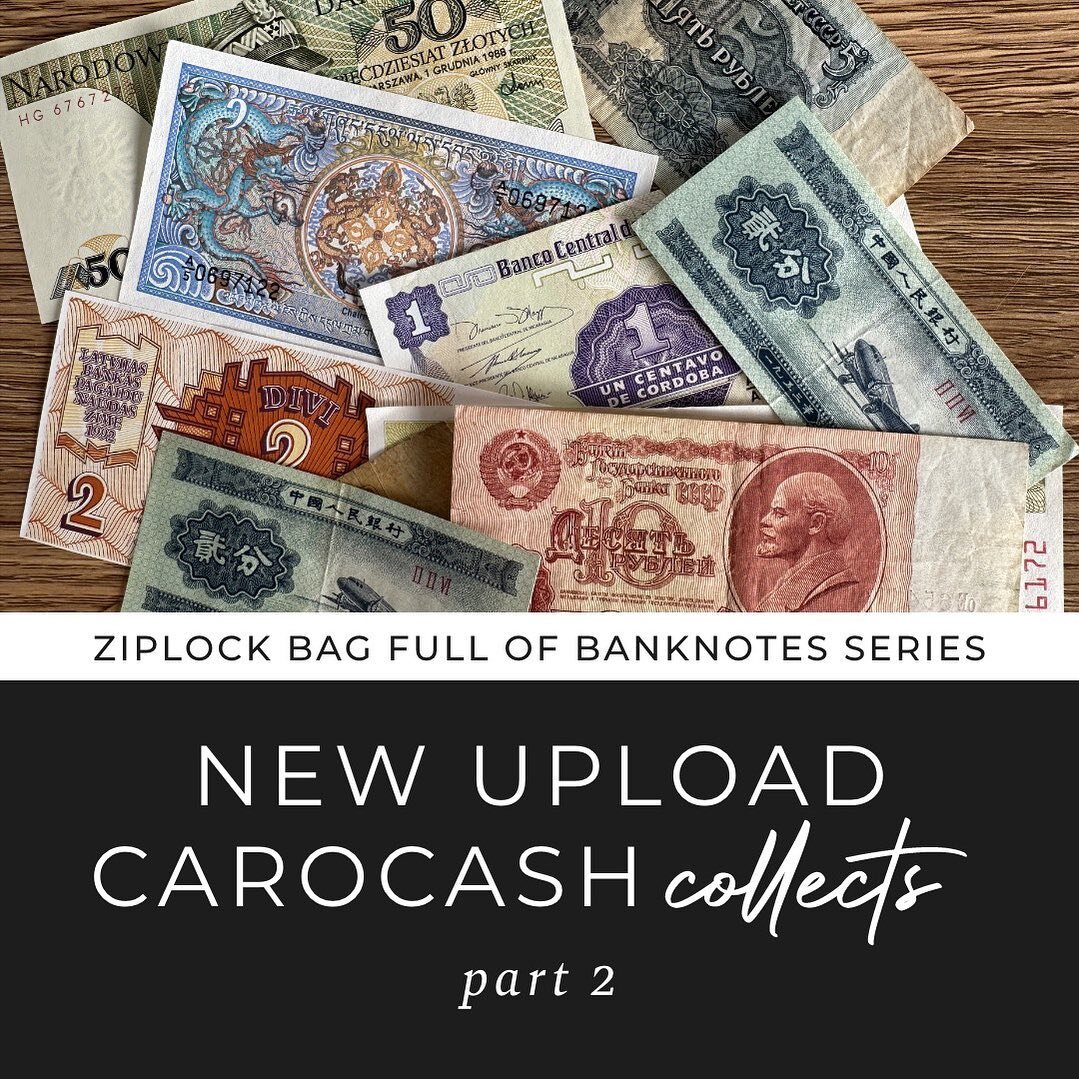

I love to collect coins/banknotes, plants, and I love a good movie with ofcourse, a Pepsi Max! #pepsicheers

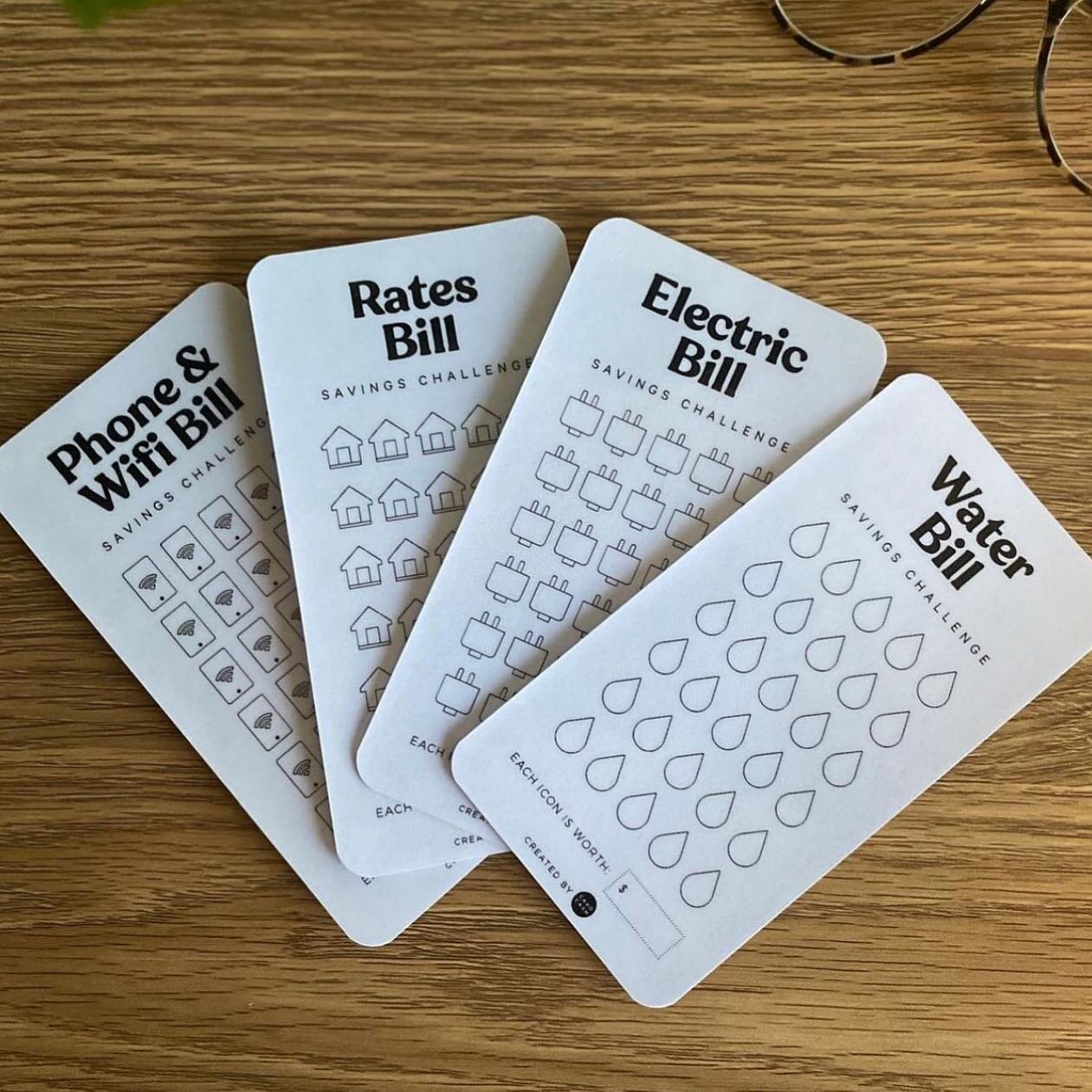

Beautifully bespoke.

Take your budgeting to a beautiful place with handmade items to help you budget your finances.

Frequently Asked Questions

-

I use Moterm binders in PERSONAL size with 30mm rings. I do not sell them, but you can purchase from Moterm, Amazon or Aliexpress.

The envelopes I use in my videos are available for purchase here. -

The cash envelope system (or “cash stuffing”) is exactly what it sounds like. You put your cash into different envelopes based on the budget categories. You’ll decide exactly what amounts go into each cash envelope based on your spending goals and budget.

For eg, you might put $300 in the “grocery fund” and $150 in “fun fund”. The key is that you only spend the cash out of these envelopes for the specific budget category until the next cycle of your budget.

-

This system helps those who don’t feel ontop of their finances and who struggle to see where their money goes. Who find it hard to budget and save for annual bills and savings.

By doing the Cash Envelope System, you budget out your pay and then physically see the money grow OR see where your money goes.

-

The first thing you need to do is create your budget. To start building a successful budget, you’ll need to track your spending and see where your money is currently be spent. Work out how much income versus outgoing spending you’re making and split up your pay into those spending categories.

You’ll likely need to tweak it over time. Life changes as you grow and you’ll need to adapt to new expenses as they arise.

-

Once you have tracked your spending for at least a month, you can separate this spending into cash envelope categories. Some examples of variable cash envelope categories: Groceries, Restaurants, Petrol, Fun, Beauty, Pet, Holidays, Clothes, Hobby…

If you’ve spent more than you’ve expected, then the cash envelope system could be the perfect solution. It will force you to think about your spending before you make the purchase.

-

As a way of not storing huge sums of money at home, I use 'prop money' / 'fake money' when you reach larger amounts.

For example, once I reach $1000 in cash, I swap that with a prop note and get the $1000 back to the bank.

The prop note is safer and it also acts as a visual representation of what is now safe sitting in the bank.

I never recommend having large sums of money in your home.

-

I can only speak for my own situation and behavioural habits, but I found splitting up my income digitally, it was too easy to “tap and pay” and do multiple online purchasing and overspending in categories without even realising it. Before I knew it, my pay had been spent and I was left not having enough for my bills.

Hopefully, once you have accomplished seeing your money grow, your mindset on spending has changed and becomes habitual.

-

Don’t compare yourself to others because you are the person who will need to stick to the budget. No two budgets are the same.

Also, don’t try to restrict yourself too much at one time because you might be more likely to break your resolve.

It can feel like a complicated process for the first couple of months. But once you get the hang of it, you might find it infinitely more effective than your previous budgeting methods.

-

Over on my Youtube channel I document MY journey, however, I always state that I am not a financial advisor. I show my journey online as a way of helping me be held accountable and showing how I am budgeting out my money.

If anyone out there watching who has serious financial issues, I recommend you to always seek professional help from a qualified financial advisor.

-

Some banks allow splitting of accounts (which allows you to have all your envelopes in digital form as well). If yours doesn’t, just make sure you have up-to-date cash trackers letting you know how much is in each envelope, or use prop notes that represents what is sitting in the bank for that category.

So if you have $5K today in your bank account, and you have $1K prop note in your car envelope, you know out of the $5K, that $1K is dedicated for your car fund.

-

You don’t need to spend lots of money to do this. You can start the cash envelope system by using just plain envelopes or zip-lock bags.

I know we all love pretty things, and I do sell budgeting products on my Etsy Store, but the reality is, you can start this system for next to nothing. The whole purpose is to get you in a routine and putting aside money for funds. Once you get the hang of doing that and you start saving, then you can budget and save up for a nicer set up, if you wish.

I do offer a Etsy Savings Challenge for those who would like to budget their future spendings.

#getsocial

Contact me.

If you would like to send me a postcard or some happy mail, please send to:

CAROCASH

PO Box 8025

Tumbi Umbi, NSW, 2261

Australia